Thomas Ross, MBA

Executive Director, Commercial Strategy, MIRADOR Global

In our first paper, we discussed how the forecasting process can serve as the backbone to important strategic thinking. Working across functional teams to identify and quantify key assumptions, agreeing on a forecasting approach, building consensus for expectations, and developing communications all serve to stimulate and unite strategic thinking among product leadership.

In part 2 of our forecasting series, the focus is on products in phase 2 through completion of phase 3 clinical programs. Considerations for a robust, defensible, and informative pre-launch forecast include choosing an approach that will deliver the required outputs customized to the organization, tailoring the forecast to the needs of the organization, developing a forecast appropriate for the intended audience, and forecasting with suitable level of detail.

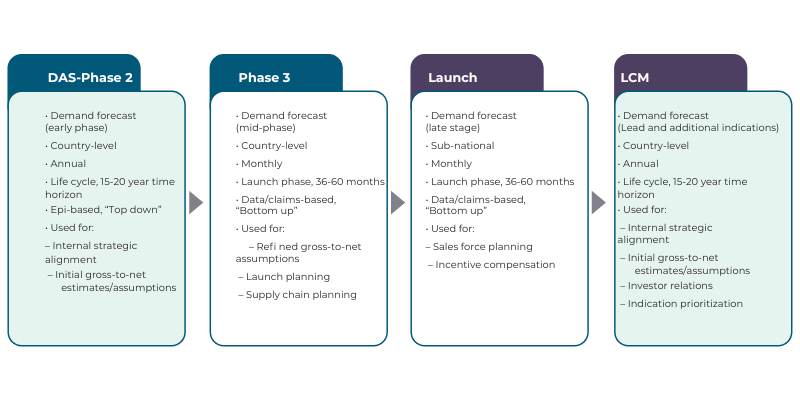

Product forecasts should be developed for a number of reasons (e.g. acquiring additional rounds of funding, financial planning, resource planning and allocation, launch planning) based on a product’s lifecycle phase and the size and maturity of the organization. Typically, as a product moves through clinical development, the forecast will evolve from one of opportunity assessment to a more detailed analysis in terms of volume, source of business, frequency (monthly vs quarterly vs annual), and with a greater focus on market details such as diagnosis and treatment rates, payer coverage, and patient compliance.

Understanding the intended audiences for a pre-launch forecast should be considered when developing your approach.

For example:

Medical, scientific, commercial, financial, market access, and other cross-functional leaders will have interests that overlap including label assumptions, product demand, market landscape, gross to net modeling, pricing, and the interplay between the assumptions. Consider all the audiences that may be utilizing your forecast to design an approach that meets their needs.

Communication of a forecast, including the approach, assumptions, and results, can make or break acceptance of the forecast and dependent strategic decisions. Choosing an approach that can clearly be explained, focusing on assumptions that propel the business, and delivering a forecast that resonates will ensure buy-in from your audience. Consideration of all potential audiences throughout the process will drive a forecast that can be used and owned by

the organization.

The modeling approach is shaped by the factors discussed above, as well as practical considerations like available resources, timelines, and accessible information. Earlier stage (Phase 2) product forecasts typically focus on sizing the opportunity in broad strokes and therefore rely on publicly available information for patient volume, current treatments, treating specialties, payer coverage and pricing determined by benchmark products. An informative forecast can be built by applying this information along with assumptions related to peak market share, share growth curves, and patient adherence. These are typically annual models at a national level.

As products progress through development, greater demands are placed on the forecast as more detailed questions are raised both internally and externally. To meet these needs, forecasts typically begin to incorporate proprietary secondary data (e.g. prescription claims, medical claims) and more detailed assumptions (e.g., payer mix, rebate rates, institutional segmentation), and are modeled at a more granular level (e.g., monthly, sub-national, by physician specialty, by indication). These models become more complex, unwieldly, and require greater commitment of resources.

At product launch and beyond, detailed forecast models are typically maintained for the product as well as competitors or the market. During the peri-launch and growth period, measuring forecast accuracy and dialing it into actual performance is an opportunity to drive additional strategic discussions. Later in the lifecycle, when a growth trajectory has been established, it is common for the forecast to be driven by a statistical trend +/- any product or market events (e.g., competitive launch, change in payer coverage, loss of exclusivity).

There is always debate about the level of detail to include in a forecast. Choosing a set of assumptions to demonstrate a robust depiction of the market must be balanced with adding so many assumptions that the model becomes too complex to explain. Usually, the more assumptions included in the model, the lower the resulting forecast will be. However, including more assumptions (e.g., incidence, treating specialty, number or % of patients diagnosed) enhances the strategic discussion and peripheral value of the forecasting process. Striking the right balance of assumptions is critical.

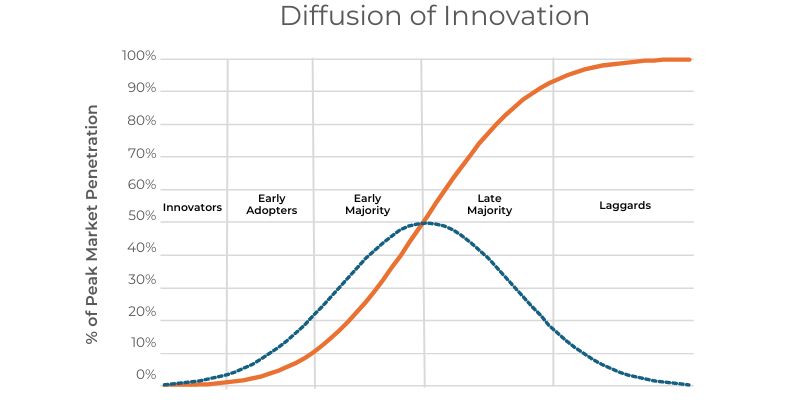

As more complex and detailed models are implemented, it is often wise to cross-check your model with alternative approaches. In a pre-launch situation, looking at a forecast from the perspective of patient and physician behavior is a valuable exercise. Is a reasonable rate of physician trial and adoption going to support your bottom-up epi-based forecast or will every treating physician need to be writing 10 prescriptions in the first month? Do patients see their doctor frequently enough to support any competitive switching assumptions? Are there enough treating providers to support patient demand or is there a 6-month wait to get an appointment? Often, this one-off parallel analysis can help gauge the viability of the forecast.

When developing a forecast for a pre-launch product, there is no “one size fits all” solution. Attention to purpose, audience, timing, and available resources will drive a successful model. The level of detail and source for assumptions can vary from public information to secondary data to primary quantitative research, resulting in a forecast that is fit-for-purpose and valuable to the organization. When designing and implementing a forecast model, the discussions and decisions will inform the brand team far beyond the quantitative result.

In our next forecasting white paper, we will explore several forecasting approaches, the pros/cons of those approaches, and when to use them. Until then, reach out to MIRADOR Global to shape the future value of your pharma asset and leverage your forecast to enable strategic conversations in your organization.

Executive Director, Commercial Strategy, MIRADOR Global